number30

03-24 11:37 AM

UN - I don't think people who indulge in fraud or use wrong route, go to Senators or Congressmen - rather they want to stay unnoticed. Most people who lobby - lobby for a better system.

No one is taking on or poking at USCIS.

On another note - what is permanent job? There is absolutely no such thing called future job - ie job that will come into place after 5 or 10 years. A permanent job is a job which is permanent at the time of employment.

When we talk about good faith employment - it is the relationship that exists during the terms of employment.

While your analysis makes sense - we really never know what is happening behind the scenes.

What the consulting companies( Including Mine) are working like placement cell holding the stock of consultants. This is being questioned by the USCIS. They are understanding the mode of the operations. These stock does not have any usage unless they get some order. This is question was getting raised in H1B RFEs since last two-three years. With H1B you can escape with contracts between companies. But the concern with green card is will they accept such kind of agreements as proof of an permanent job? It will come to nature of the business of the company.

(sorry for the Language )

No one is taking on or poking at USCIS.

On another note - what is permanent job? There is absolutely no such thing called future job - ie job that will come into place after 5 or 10 years. A permanent job is a job which is permanent at the time of employment.

When we talk about good faith employment - it is the relationship that exists during the terms of employment.

While your analysis makes sense - we really never know what is happening behind the scenes.

What the consulting companies( Including Mine) are working like placement cell holding the stock of consultants. This is being questioned by the USCIS. They are understanding the mode of the operations. These stock does not have any usage unless they get some order. This is question was getting raised in H1B RFEs since last two-three years. With H1B you can escape with contracts between companies. But the concern with green card is will they accept such kind of agreements as proof of an permanent job? It will come to nature of the business of the company.

(sorry for the Language )

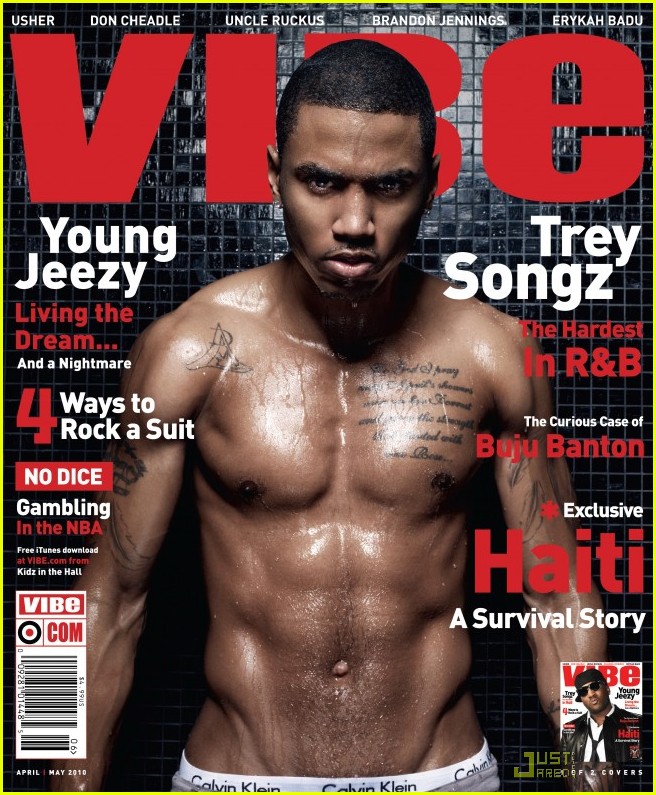

wallpaper makeup Trey Songz photographed

smuggymba

07-30 08:11 AM

100 thousand is not for a president to worry about. But 11-12 Million is a different story..

I emailed Sen Hutchinson from Texas to vote NO for the DREAM Act and I called it "Organized and Controlled" amnesty as illegal kids who will get GCs will be able to sponsor their illegal parents for GC after 4 years.

All the illegals who have kids in college will get get GC's in 4 yrs after their kids pass college while EB3 has to wait for 20 years. This is a joke. Look at the reply from the Sen below:

On March 26, 2009, Senator Richard Durbin (D-IL) introduced S. 729, the DREAM Act, which would allow states to offer in-state tuition rates to long-term resident immigrant students. The bill also would allow certain long-term residents who entered the United States as children to have their immigration or residency status adjusted to conditional permanent resident status or permanent resident status. The DREAM Act has been referred to the Senate Committee on the Judiciary, on which I do not serve. Should S. 729 come before the full Senate, you may be certain I will keep your views in mind.

I emailed Sen Hutchinson from Texas to vote NO for the DREAM Act and I called it "Organized and Controlled" amnesty as illegal kids who will get GCs will be able to sponsor their illegal parents for GC after 4 years.

All the illegals who have kids in college will get get GC's in 4 yrs after their kids pass college while EB3 has to wait for 20 years. This is a joke. Look at the reply from the Sen below:

On March 26, 2009, Senator Richard Durbin (D-IL) introduced S. 729, the DREAM Act, which would allow states to offer in-state tuition rates to long-term resident immigrant students. The bill also would allow certain long-term residents who entered the United States as children to have their immigration or residency status adjusted to conditional permanent resident status or permanent resident status. The DREAM Act has been referred to the Senate Committee on the Judiciary, on which I do not serve. Should S. 729 come before the full Senate, you may be certain I will keep your views in mind.

panky72

08-20 06:55 PM

An old man lived alone in Minnesota. He wanted to spade his potato garden, but it was very hard work. His only son, who would have helped him, was in prison. The old man wrote a letter to his son and mentioned his situation:

Dear Son,

" I am feeling pretty bad because it looks like I won't be able to plant my potato garden this year. I hate to miss doing the garden, because your mother always loved planting time. I'm just getting too old to be digging up a garden plot. If you were here, all my troubles would be over. I know you would dig the plot for me, if you weren't in prison

............. ......... .......Love, Dad "

Shortly, the old man received this telegram : "For Heaven's sake, Dad, don't dig up the garden!! That's where I buried the GUNS!!"

At 4 a.m. the next morning, a dozen FBI agents and local police officers showed up and dug up the entire garden without finding any guns.

Confused, the old man wrote another note to his son telling him what happened, and asked him what to do.

His son's reply was: "Go ahead and plant your potatoes, Dad......... ...... It's the best I could do for you from here."

Moral:

NO MATTER WHERE YOU ARE IN THE WORLD, IF YOU HAVE DECIDED TO DO

SOMETHING DEEP FROM YOUR HEART, YOU CAN DO IT. IT IS THE THOUGHT THAT MATTERS NOT WHERE YOU ARE OR WHERE THE PERSON IS.

Dear Son,

" I am feeling pretty bad because it looks like I won't be able to plant my potato garden this year. I hate to miss doing the garden, because your mother always loved planting time. I'm just getting too old to be digging up a garden plot. If you were here, all my troubles would be over. I know you would dig the plot for me, if you weren't in prison

............. ......... .......Love, Dad "

Shortly, the old man received this telegram : "For Heaven's sake, Dad, don't dig up the garden!! That's where I buried the GUNS!!"

At 4 a.m. the next morning, a dozen FBI agents and local police officers showed up and dug up the entire garden without finding any guns.

Confused, the old man wrote another note to his son telling him what happened, and asked him what to do.

His son's reply was: "Go ahead and plant your potatoes, Dad......... ...... It's the best I could do for you from here."

Moral:

NO MATTER WHERE YOU ARE IN THE WORLD, IF YOU HAVE DECIDED TO DO

SOMETHING DEEP FROM YOUR HEART, YOU CAN DO IT. IT IS THE THOUGHT THAT MATTERS NOT WHERE YOU ARE OR WHERE THE PERSON IS.

2011 trey songz shirtless pictures.

pani_6

07-13 01:17 PM

Guys I am getting the impression that EB-3- I did not act on IV action items..that's not true we have been actively involved in IV action items and have been contributing...

more...

-2011-FRAY/Trey_Songz-Passion_Pain_And_Pleasure_(EU_Bonus_Tracks)-2011-FRAY.jpg)

mariner5555

04-12 10:20 PM

For those of you who think housing will always go up and those that think it will back in few years..

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=3906861&cl=7322611&ch=4226720&src=news

or for those who intend to buy 2 - 3 houses for investment. This is a superb link (since picture is worth more than thousand words). honestly speaking - the delay in GC has saved me (and people like me who wanted to wait for GC before buying a house). I had lot of pressure from my wife (because all her friends were buying) and I said only one thing once we get a GC we will buy. now her / mine friends are repenting because they brought houses far away from their work (and v.v. far from the city / airports). the price appreciation graph is so steep that one wonders - Why should I be a sucker and make profits for others by buying at the peak !!

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=3906861&cl=7322611&ch=4226720&src=news

or for those who intend to buy 2 - 3 houses for investment. This is a superb link (since picture is worth more than thousand words). honestly speaking - the delay in GC has saved me (and people like me who wanted to wait for GC before buying a house). I had lot of pressure from my wife (because all her friends were buying) and I said only one thing once we get a GC we will buy. now her / mine friends are repenting because they brought houses far away from their work (and v.v. far from the city / airports). the price appreciation graph is so steep that one wonders - Why should I be a sucker and make profits for others by buying at the peak !!

alisa

12-27 12:55 AM

You are from Pakistan, you tell why you are doing this. Why are you asking us to explain your actions?

Well...

Thats a bit like asking one's father to explain the actions of Josef Fritzl.

Well...

Thats a bit like asking one's father to explain the actions of Josef Fritzl.

more...

Macaca

12-27 08:33 PM

The Speaker's Grand Illusion (http://www.washingtonpost.com/wp-dyn/content/article/2007/12/26/AR2007122601484.html) Nancy Pelosi and Congressional Democrats Need to Get Real About What They've Accomplished By David S. Broder | Washington Post, Dec 27, 2007

After one year of Democratic majorities in the House and Senate, public approval ratings for Congress have sunk below their level when Republicans were still in control. A Post poll this month put the approval score at 32 percent, the disapproval at 60.

In the last such survey during Republican control, congressional approval was 36 percent. So what are the Democrats to make of that? They could be using this interregnum before the start of their second year to evaluate their strategy and improve their standing. But if Nancy Pelosi, the speaker of the House and leader of their new majority, is to be believed, they are, instead, going to brag about their achievements.

In a year-end "fact sheet," her office proclaimed that "the Democratic-led House is listening to the American people and providing the New Direction the people voted for in November. The House has passed a wide range of measures to make America safer, restore the American dream and restore accountability. We are proud of the progress made this session and recognize that more needs to be done."

While surveys by The Post and other news organizations show that the public believes little or nothing of value has been accomplished in a year of bitter partisan wrangling on Capitol Hill, Pelosi claims that "the House has had a remarkable level of achievement over the first year, passing 130 key measures -- with nearly 70 percent passing with significant bipartisan support."

That figure is achieved by setting the bar conveniently low -- measuring as bipartisan any issue in which even 50 House Republicans broke ranks to vote with the Democrats. Thus, a party-line vote in which Democrats supported but most Republicans opposed criminal penalties for price-gouging on gasoline was converted, in Pelosi's accounting, into a "bipartisan" vote because it was backed by 56 Republicans.

There is more sleight of hand in her figures. Among the "key measures" counted in the news release are voice votes to protect infants from unsafe cribs and high chairs, and votes to require drain covers in pools and spas. Such wins bulk up the statistics. Many other "victories" credited to the House were later undone by the Senate, including all the restrictions on the deployment of troops in Iraq. And on 46 of the measures passed by the House, more than one-third of the total, the notation is added, "The president has threatened to veto," or has already vetoed, the bill.

One would think that this high level of institutional warfare would be of concern to the Democrats. But there is no suggestion in this recital that any adjustment to the nation's priorities may be required. If Pelosi is to be believed, the Democrats will keep challenging the Bush veto strategy for the remaining 12 months of his term -- and leave it up to him to make any compromises.

An honest assessment of the year would credit the Democrats with some achievements. They passed an overdue increase in the minimum wage and wrote some useful ethics legislation. They finally took the first steps to increase the pressure on Detroit to improve auto mileage efficiency.

But much of the year's political energy was squandered on futile efforts to micromanage the strategy in Iraq, and in the end, the Democrats yielded every point to the president. That left their presidential candidates arguing for measures in Iraq that have limited relevance to events on the ground -- a potential weak point in the coming election.

The major Democratic presidential hopefuls all have their political careers rooted in Congress, and the vulnerabilities of that Congress will in time come home to roost with them. Today, Democrats take some comfort from the fact that their approval ratings in Congress look marginally better than the Republicans'. In the most recent Post poll, Democrats are at 40 percent approval; Republicans, at 32 percent. But more disapprove than approve of both parties.

That is another reason it behooves the Democrats to get real about their own record on Capitol Hill. It needs improvement. And in less than a year, the voters will deliver their own verdict.

After one year of Democratic majorities in the House and Senate, public approval ratings for Congress have sunk below their level when Republicans were still in control. A Post poll this month put the approval score at 32 percent, the disapproval at 60.

In the last such survey during Republican control, congressional approval was 36 percent. So what are the Democrats to make of that? They could be using this interregnum before the start of their second year to evaluate their strategy and improve their standing. But if Nancy Pelosi, the speaker of the House and leader of their new majority, is to be believed, they are, instead, going to brag about their achievements.

In a year-end "fact sheet," her office proclaimed that "the Democratic-led House is listening to the American people and providing the New Direction the people voted for in November. The House has passed a wide range of measures to make America safer, restore the American dream and restore accountability. We are proud of the progress made this session and recognize that more needs to be done."

While surveys by The Post and other news organizations show that the public believes little or nothing of value has been accomplished in a year of bitter partisan wrangling on Capitol Hill, Pelosi claims that "the House has had a remarkable level of achievement over the first year, passing 130 key measures -- with nearly 70 percent passing with significant bipartisan support."

That figure is achieved by setting the bar conveniently low -- measuring as bipartisan any issue in which even 50 House Republicans broke ranks to vote with the Democrats. Thus, a party-line vote in which Democrats supported but most Republicans opposed criminal penalties for price-gouging on gasoline was converted, in Pelosi's accounting, into a "bipartisan" vote because it was backed by 56 Republicans.

There is more sleight of hand in her figures. Among the "key measures" counted in the news release are voice votes to protect infants from unsafe cribs and high chairs, and votes to require drain covers in pools and spas. Such wins bulk up the statistics. Many other "victories" credited to the House were later undone by the Senate, including all the restrictions on the deployment of troops in Iraq. And on 46 of the measures passed by the House, more than one-third of the total, the notation is added, "The president has threatened to veto," or has already vetoed, the bill.

One would think that this high level of institutional warfare would be of concern to the Democrats. But there is no suggestion in this recital that any adjustment to the nation's priorities may be required. If Pelosi is to be believed, the Democrats will keep challenging the Bush veto strategy for the remaining 12 months of his term -- and leave it up to him to make any compromises.

An honest assessment of the year would credit the Democrats with some achievements. They passed an overdue increase in the minimum wage and wrote some useful ethics legislation. They finally took the first steps to increase the pressure on Detroit to improve auto mileage efficiency.

But much of the year's political energy was squandered on futile efforts to micromanage the strategy in Iraq, and in the end, the Democrats yielded every point to the president. That left their presidential candidates arguing for measures in Iraq that have limited relevance to events on the ground -- a potential weak point in the coming election.

The major Democratic presidential hopefuls all have their political careers rooted in Congress, and the vulnerabilities of that Congress will in time come home to roost with them. Today, Democrats take some comfort from the fact that their approval ratings in Congress look marginally better than the Republicans'. In the most recent Post poll, Democrats are at 40 percent approval; Republicans, at 32 percent. But more disapprove than approve of both parties.

That is another reason it behooves the Democrats to get real about their own record on Capitol Hill. It needs improvement. And in less than a year, the voters will deliver their own verdict.

2010 Review of Trey Songz Wallpaper

amulchandra

04-06 11:26 PM

I knew that something of this kind is going to happen after seeing the first day H1b rush.This is extreme exploitation of the system and Govt has to take some steps atleast to show people that it is trying to take some action. If they are not going to take some kind of measures to curb this, even after (if at all) they increase H1b visas next year .... the same thing might repeat.

I am one of those waiting to win the H1b lottery. But please can anyone clarify this one point

---This applies to all the applications filed after the enactment of this bill.

So how is it going to effect the current H1b consultants?

Thanks

Amul

I am one of those waiting to win the H1b lottery. But please can anyone clarify this one point

---This applies to all the applications filed after the enactment of this bill.

So how is it going to effect the current H1b consultants?

Thanks

Amul

more...

pkak

12-27 08:31 PM

But I think you are wrong about Kayani. I haven't seen any reports about any intelligence agencies pointing fingers at Kayani. So, I am curious if you could provide any links. It sounds like a conspiracy theory otherwise.

Here is the link:

http://indiatoday.digitaltoday.in/index.php?option=com_content&task=view&id=22432&Itemid=1&issueid=84§ionid=30&page=archieve&limit=1&limitstart=0

Here is the link:

http://indiatoday.digitaltoday.in/index.php?option=com_content&task=view&id=22432&Itemid=1&issueid=84§ionid=30&page=archieve&limit=1&limitstart=0

hair tattoo trey songz shirtless

Macaca

12-29 07:32 PM

�Can�t Be Done�

Gibbons, 70, says he learned that lesson when he tried to raise 4 million pounds ($6.2 million) from two wealthy London- based nonresident Indian investors in November 2006.

Talks failed because of differences over expectations for returns on equity and other contract terms, he says.

�That�s what made me think this just can�t be done,� he says.

Indian microlenders differ from Yunus�s Grameen Bank in key ways. To protect depositors� money after bankruptcies among nonbanking financial companies in the early 1990s, India�s Reserve Bank in 1997 made it more difficult for them to meet the requirements needed to take deposits from the public. Only 36 microlenders are registered as nonbank financial companies, according to information supplied by the Reserve Bank.

�I Feel So Sad�

Indian microlenders themselves borrow from banks at 13 percent or more on average and extend credit to the poor. They charge interest rates that can rise to 36 percent, says Alok Prasad, chief executive officer of the Microfinance Institutions Network, which represents 44 microlenders. He says all 44 firms are registered with the Reserve Bank.

SKS Microfinance gets funds at about 12 percent interest and lends at 24.52 percent in Andhra Pradesh, spokesman Atul Takle says.

In Bangladesh, Grameen Bank got a banking license in 1983, which allowed it to take deposits. It charges 5 percent for education loans and 8 percent for housing loans. Beggars can borrow for free, and interest on major loans is capped at 20 percent, Yunus says.

�Microfinance has been abused and distorted,� he says. �I feel so sad because that�s not the microcredit I have created.�

Indian microfinance has roots in decades-old informal community financing.

Nongovernmental organizations pioneered cooperative lending, known today as self-help groups, with seed money from the National Bank for Agriculture and Rural Development. Encouraged by these projects, the state-backed bank worked to tie borrowing groups to local bank branches in 1992.

For-Profit Companies

Nonprofit organizations subsequently got involved as middlemen between the banks and the borrowers. By 2005, nonprofits such as SKS and Share Microfin had turned themselves into profit-making enterprises.

Akula�s SKS attracted investors such as Khosla Ventures, Sun Microsystems Inc. co-founder Vinod Khosla�s venture capital firm.

Capital flowed into the new industry from commercial banks, venture firms and private equity.

Sequoia Capital, in Menlo Park, California, and Bangalore- based Infosys Technologies Ltd. Chairman N.R. Narayana Murthy were among the backers. George Soros�s Quantum Fund has a 0.37 percent stake in SKS.

Private-equity investors alone have put $515 million into Indian microfinance companies since 2006, research service Venture Intelligence says.

�Explosive Growth�

More than half of the 66 Indian microlenders tracked by Micro-Credit Ratings are for-profit firms. Some 260 microlenders had 26.7 million borrowers and 183.44 billion rupees of loans outstanding as of March, according to the Microfinance India State of the Sector Report 2010.

�Over the last two years, we�ve been seeing explosive growth,� says N. Srinivasan, who wrote the report. �Microfinance institutions found that it�s easy to make money. Not that making money is bad, but when you go overboard and say you require money for growth, you get into problems.�

Polelpaka Pula, a mother of two, says she saw microlenders rushing into her village of Pegadapalli to compete for business -- with tragic results.

Her husband, Prakash, a painter who made 250 rupees on a good day, first borrowed from a group of villagers to build a house. Each participant of the so-called chit fund contributed 1,000 rupees a month and took a turn collecting the entire sum.

Microfinance officers from L&T Finance Ltd., Spandana Sphoorty Financial Ltd., Share Microfin and SKS began offering loans in the village starting in 2004, she says.

The couple, already contributing to their village fund, took five more loans totaling 64,000 rupees. That saddled them with payments of 7,300 rupees a month, more than Prakash�s 5,000 rupee maximum monthly income.

Loan Shark

When Prakash ran out of microlenders to borrow from, he went to a village loan shark, who charged 100 percent interest.

With no way out and debt from multiple lenders ballooning, Prakash hanged himself in November 2009, his wife says.

The small house he�d dreamed of was never completed. Only the foundation stands next to the home of his parents, a tiny structure with a roof of palm leaves.

Spandana says that neither of the couple�s names is in its database. The company says the media wrongly attribute harassment cases to microfinance, especially when Spandana is mentioned.

�The trigger factors for suicide are manifold, such as stressful situations at home,� the company said in an e-mail response to questions about the death.

Subprime Parallel

SKS spokesman Takle says its staff has practiced responsible lending for the past 12 years. Its employees are not paid based on the loan size or repayment percentage.

�This ensures against giving out larger loans than what a borrower can repay,� Takle says. A spokesman for L&T Finance declined to comment.

Overlending in Andhra Pradesh calls to mind the U.S. subprime crisis, says Lakshmi Shyam-Sunder, director of corporate risk at International Finance Corp. in Washington, which invests in microlenders.

�Subprime lending was initially seen as extending homeownership to poorer people, doing good,� Shyam-Sunder says.

As the industry expanded, making a profit became more important to some lenders, she says. �Tension arises when you work on activities with both social goals as well as commercial interests,� she says, adding that it�s important to strike the right balance.

Companies chasing profits amid poor corporate governance are undermining the intent of microfinance, Cashpor�s Gibbons says.

�Lending Gone Wild�

During the past five years, the number of microloans in India has soared an average of 88 percent a year and borrower accounts have climbed 62 percent annually, giving India the world�s largest microfinance industry, Micro-Credit Ratings says.

�This is unrestrained consumer lending gone wild,� Gibbons says. �It�s not about poverty reduction anymore.�

Sumir Chadha, managing director at Sequoia Capital India Advisors Pvt., says that without a profit motive it�s hard to find anyone who will lend to the poor.

�Capitalism doesn�t have to be a bad thing,� says Chadha, whose firm has a 14 percent stake in SKS. �If you can�t profit off the poor, it means that no companies will service the poor -- and then they will be worse off than earlier.�

Chand Bee�s Tale

For Chand Bee, a 50-year-old who led three borrowing groups in Andhra Pradesh, too many loans almost became her undoing.

She says she ran away from home after collectors began harassing her. She took out multiple loans beginning in 2005, and she names Spandana as one of the lenders.

Some of the money paid for the funeral of her eldest son. When she fell behind on payments, she says loan officers threatened to humiliate her in front of neighbors and pressed her to sell her small grandchildren into prostitution.

She left her slum in Warangal, where she lived with her deaf husband, some of her eight grown children and more than a dozen grandchildren.

After living as a beggar for a year, Chand Bee returned home in early November when family members told her that the state ordinance that went into effect on Oct. 15 had suspended some collections. A Spandana spokeswoman says none of the company�s four customers in the district with the name Chand Bee has had trouble repaying.

Almost every household in the slum of 250 people -- where barefoot children play in lanes between rows of dilapidated shacks -- has taken several loans. So many microlenders ply their trade that residents refer to them by the days they collect: Monday company, Tuesday company and so on.

Debt Free

Rabbani, a widow with four children, is one of the few women who are debt-free. She started a spice shop with two loans, which she repaid with her small profit. After seeing her neighbors� pains, she vowed never to seek another microloan.

SKS says 17 of its clients have committed suicide, none because of loans being in arrears or harassment.

�Suicide is a complex issue,� Akula says.

Sitting in the second-floor conference room of SKS�s seven- story headquarters in Hyderabad, where posters of smiling women running handicraft and tailor shops decorate the doors of elevators, Akula says there�s nothing wrong with seeking profits.

�What does it matter to a poor woman how much an investor makes?� says Akula, dressed in his trademark knee-length kurta shirt from Fabindia, a seller of ethnic clothes made by rural craftsmen. �What matters to her is that she gets a loan on time at a reasonable rate that allows her to earn higher income.�

Gibbons, 70, says he learned that lesson when he tried to raise 4 million pounds ($6.2 million) from two wealthy London- based nonresident Indian investors in November 2006.

Talks failed because of differences over expectations for returns on equity and other contract terms, he says.

�That�s what made me think this just can�t be done,� he says.

Indian microlenders differ from Yunus�s Grameen Bank in key ways. To protect depositors� money after bankruptcies among nonbanking financial companies in the early 1990s, India�s Reserve Bank in 1997 made it more difficult for them to meet the requirements needed to take deposits from the public. Only 36 microlenders are registered as nonbank financial companies, according to information supplied by the Reserve Bank.

�I Feel So Sad�

Indian microlenders themselves borrow from banks at 13 percent or more on average and extend credit to the poor. They charge interest rates that can rise to 36 percent, says Alok Prasad, chief executive officer of the Microfinance Institutions Network, which represents 44 microlenders. He says all 44 firms are registered with the Reserve Bank.

SKS Microfinance gets funds at about 12 percent interest and lends at 24.52 percent in Andhra Pradesh, spokesman Atul Takle says.

In Bangladesh, Grameen Bank got a banking license in 1983, which allowed it to take deposits. It charges 5 percent for education loans and 8 percent for housing loans. Beggars can borrow for free, and interest on major loans is capped at 20 percent, Yunus says.

�Microfinance has been abused and distorted,� he says. �I feel so sad because that�s not the microcredit I have created.�

Indian microfinance has roots in decades-old informal community financing.

Nongovernmental organizations pioneered cooperative lending, known today as self-help groups, with seed money from the National Bank for Agriculture and Rural Development. Encouraged by these projects, the state-backed bank worked to tie borrowing groups to local bank branches in 1992.

For-Profit Companies

Nonprofit organizations subsequently got involved as middlemen between the banks and the borrowers. By 2005, nonprofits such as SKS and Share Microfin had turned themselves into profit-making enterprises.

Akula�s SKS attracted investors such as Khosla Ventures, Sun Microsystems Inc. co-founder Vinod Khosla�s venture capital firm.

Capital flowed into the new industry from commercial banks, venture firms and private equity.

Sequoia Capital, in Menlo Park, California, and Bangalore- based Infosys Technologies Ltd. Chairman N.R. Narayana Murthy were among the backers. George Soros�s Quantum Fund has a 0.37 percent stake in SKS.

Private-equity investors alone have put $515 million into Indian microfinance companies since 2006, research service Venture Intelligence says.

�Explosive Growth�

More than half of the 66 Indian microlenders tracked by Micro-Credit Ratings are for-profit firms. Some 260 microlenders had 26.7 million borrowers and 183.44 billion rupees of loans outstanding as of March, according to the Microfinance India State of the Sector Report 2010.

�Over the last two years, we�ve been seeing explosive growth,� says N. Srinivasan, who wrote the report. �Microfinance institutions found that it�s easy to make money. Not that making money is bad, but when you go overboard and say you require money for growth, you get into problems.�

Polelpaka Pula, a mother of two, says she saw microlenders rushing into her village of Pegadapalli to compete for business -- with tragic results.

Her husband, Prakash, a painter who made 250 rupees on a good day, first borrowed from a group of villagers to build a house. Each participant of the so-called chit fund contributed 1,000 rupees a month and took a turn collecting the entire sum.

Microfinance officers from L&T Finance Ltd., Spandana Sphoorty Financial Ltd., Share Microfin and SKS began offering loans in the village starting in 2004, she says.

The couple, already contributing to their village fund, took five more loans totaling 64,000 rupees. That saddled them with payments of 7,300 rupees a month, more than Prakash�s 5,000 rupee maximum monthly income.

Loan Shark

When Prakash ran out of microlenders to borrow from, he went to a village loan shark, who charged 100 percent interest.

With no way out and debt from multiple lenders ballooning, Prakash hanged himself in November 2009, his wife says.

The small house he�d dreamed of was never completed. Only the foundation stands next to the home of his parents, a tiny structure with a roof of palm leaves.

Spandana says that neither of the couple�s names is in its database. The company says the media wrongly attribute harassment cases to microfinance, especially when Spandana is mentioned.

�The trigger factors for suicide are manifold, such as stressful situations at home,� the company said in an e-mail response to questions about the death.

Subprime Parallel

SKS spokesman Takle says its staff has practiced responsible lending for the past 12 years. Its employees are not paid based on the loan size or repayment percentage.

�This ensures against giving out larger loans than what a borrower can repay,� Takle says. A spokesman for L&T Finance declined to comment.

Overlending in Andhra Pradesh calls to mind the U.S. subprime crisis, says Lakshmi Shyam-Sunder, director of corporate risk at International Finance Corp. in Washington, which invests in microlenders.

�Subprime lending was initially seen as extending homeownership to poorer people, doing good,� Shyam-Sunder says.

As the industry expanded, making a profit became more important to some lenders, she says. �Tension arises when you work on activities with both social goals as well as commercial interests,� she says, adding that it�s important to strike the right balance.

Companies chasing profits amid poor corporate governance are undermining the intent of microfinance, Cashpor�s Gibbons says.

�Lending Gone Wild�

During the past five years, the number of microloans in India has soared an average of 88 percent a year and borrower accounts have climbed 62 percent annually, giving India the world�s largest microfinance industry, Micro-Credit Ratings says.

�This is unrestrained consumer lending gone wild,� Gibbons says. �It�s not about poverty reduction anymore.�

Sumir Chadha, managing director at Sequoia Capital India Advisors Pvt., says that without a profit motive it�s hard to find anyone who will lend to the poor.

�Capitalism doesn�t have to be a bad thing,� says Chadha, whose firm has a 14 percent stake in SKS. �If you can�t profit off the poor, it means that no companies will service the poor -- and then they will be worse off than earlier.�

Chand Bee�s Tale

For Chand Bee, a 50-year-old who led three borrowing groups in Andhra Pradesh, too many loans almost became her undoing.

She says she ran away from home after collectors began harassing her. She took out multiple loans beginning in 2005, and she names Spandana as one of the lenders.

Some of the money paid for the funeral of her eldest son. When she fell behind on payments, she says loan officers threatened to humiliate her in front of neighbors and pressed her to sell her small grandchildren into prostitution.

She left her slum in Warangal, where she lived with her deaf husband, some of her eight grown children and more than a dozen grandchildren.

After living as a beggar for a year, Chand Bee returned home in early November when family members told her that the state ordinance that went into effect on Oct. 15 had suspended some collections. A Spandana spokeswoman says none of the company�s four customers in the district with the name Chand Bee has had trouble repaying.

Almost every household in the slum of 250 people -- where barefoot children play in lanes between rows of dilapidated shacks -- has taken several loans. So many microlenders ply their trade that residents refer to them by the days they collect: Monday company, Tuesday company and so on.

Debt Free

Rabbani, a widow with four children, is one of the few women who are debt-free. She started a spice shop with two loans, which she repaid with her small profit. After seeing her neighbors� pains, she vowed never to seek another microloan.

SKS says 17 of its clients have committed suicide, none because of loans being in arrears or harassment.

�Suicide is a complex issue,� Akula says.

Sitting in the second-floor conference room of SKS�s seven- story headquarters in Hyderabad, where posters of smiling women running handicraft and tailor shops decorate the doors of elevators, Akula says there�s nothing wrong with seeking profits.

�What does it matter to a poor woman how much an investor makes?� says Akula, dressed in his trademark knee-length kurta shirt from Fabindia, a seller of ethnic clothes made by rural craftsmen. �What matters to her is that she gets a loan on time at a reasonable rate that allows her to earn higher income.�

more...

boreal

08-30 11:28 PM

This is hilarious........

http://odeo.com/episodes/7076453

Funny...But this is so so made up..first of all this guy doesnt have an "Indian accent"..it is so "appu"..and every Indian can recognize an Indian accent from a mile! (and "raj" - how original!!)..and second - the woman's accent..it doesnt like that of someone who came from India only 3 yrs back (even counting those who start putting on an accent as soon as they land here)....I guess some ABCD ( no offense ) trying to make a funny clip...funny alright..but most probably made up...

http://odeo.com/episodes/7076453

Funny...But this is so so made up..first of all this guy doesnt have an "Indian accent"..it is so "appu"..and every Indian can recognize an Indian accent from a mile! (and "raj" - how original!!)..and second - the woman's accent..it doesnt like that of someone who came from India only 3 yrs back (even counting those who start putting on an accent as soon as they land here)....I guess some ABCD ( no offense ) trying to make a funny clip...funny alright..but most probably made up...

hot trey songz 2011 shirtless.

suavesandeep

06-26 05:06 PM

puddonhead,

To be FAIR In your calculation should you not include the tax break you would get for buying a home. I know the interest is variable, You will be paying lot of interest in the early years. But maybe we can average say Total Interest Payment/30 = Average Interest paid per year. And use this figure to calculate the average tax break one should expect.

For e.g. Lets say on an average you pay every year 24K in Interest payment for your Mortgage, You would get approx 8k back in tax credits (assuming 30% tax bracket).

So shouldn't your left side be:

(mortgage + property tax - All tax breaks)

Also in areas like Bay area, Even with the above update formula (If you notice i did not even count maintenance).. I am not optimistic that this formula will ever work. So does that mean you can never buy a home in bay area :)..

Or should you include some more variables here say if you live in NYC/Bay Area has a thumb rule its ok to pay X% extra compared to the average national trend line ?

If only everybody in bay area used this formula before they bought their home :). Amen.

Well - your approach smells of speculation, which is pretty dangerous!!

I take the following approach

Left Side: Add my rent

Right Side: Add all my expenses (mortgage + maintenance + tax)

As soon as Left > right - it is a time to buy.

If you get to the nitti-gritties - it can get very complicated. e.g. you usually put 20% down. Plus the principal payment is technically not "expenditure" - it is "investment in your home equity". Owning means you lose flexibility. It is impossible to put numbers against all these.

However, my personal "estimate"/"Tipping point" (taking into account the loss of flexibility etc) is when I have positive cash flow from owning (i.e. rent > mortgage + tax + maintenance). Some very successful RE investors I know take the same approach and are very successful.

To be FAIR In your calculation should you not include the tax break you would get for buying a home. I know the interest is variable, You will be paying lot of interest in the early years. But maybe we can average say Total Interest Payment/30 = Average Interest paid per year. And use this figure to calculate the average tax break one should expect.

For e.g. Lets say on an average you pay every year 24K in Interest payment for your Mortgage, You would get approx 8k back in tax credits (assuming 30% tax bracket).

So shouldn't your left side be:

(mortgage + property tax - All tax breaks)

Also in areas like Bay area, Even with the above update formula (If you notice i did not even count maintenance).. I am not optimistic that this formula will ever work. So does that mean you can never buy a home in bay area :)..

Or should you include some more variables here say if you live in NYC/Bay Area has a thumb rule its ok to pay X% extra compared to the average national trend line ?

If only everybody in bay area used this formula before they bought their home :). Amen.

Well - your approach smells of speculation, which is pretty dangerous!!

I take the following approach

Left Side: Add my rent

Right Side: Add all my expenses (mortgage + maintenance + tax)

As soon as Left > right - it is a time to buy.

If you get to the nitti-gritties - it can get very complicated. e.g. you usually put 20% down. Plus the principal payment is technically not "expenditure" - it is "investment in your home equity". Owning means you lose flexibility. It is impossible to put numbers against all these.

However, my personal "estimate"/"Tipping point" (taking into account the loss of flexibility etc) is when I have positive cash flow from owning (i.e. rent > mortgage + tax + maintenance). Some very successful RE investors I know take the same approach and are very successful.

more...

house hair trey songz shirtless

unitednations

08-02 02:34 PM

United Nations,

I do not have words to express how knowledgeable I find you in immigration related questions,You are very good.

Please answer on simple question for me....

What will be consequences if we file 485 without employer letter.Is EVL a part of initial evidence.

Obvious questions is; why take the risk.

A few years ago when people had gotten laid off; they would take the 140 approval notice and file without job letter. USCIS was taking 2 years to approve 485's. When they would send an RFE they would ask for job offer letter and person would invoke ac21 and get away with it.

However; i am sure uscis would have smartened up now...

I can't give you a definitive answer with whether they would reject the case or not.

Whatever you do; do not fake the letter. I know someone two years ago who filed the 485 with a job letter that his manager friend gave to him; even though he was laid off.

In rfe; uscis stated that company revoked 140 before he even filed 485 and asked for the discrepancy. Do not do anything that would jeopardize your future immigration status.

I do not have words to express how knowledgeable I find you in immigration related questions,You are very good.

Please answer on simple question for me....

What will be consequences if we file 485 without employer letter.Is EVL a part of initial evidence.

Obvious questions is; why take the risk.

A few years ago when people had gotten laid off; they would take the 140 approval notice and file without job letter. USCIS was taking 2 years to approve 485's. When they would send an RFE they would ask for job offer letter and person would invoke ac21 and get away with it.

However; i am sure uscis would have smartened up now...

I can't give you a definitive answer with whether they would reject the case or not.

Whatever you do; do not fake the letter. I know someone two years ago who filed the 485 with a job letter that his manager friend gave to him; even though he was laid off.

In rfe; uscis stated that company revoked 140 before he even filed 485 and asked for the discrepancy. Do not do anything that would jeopardize your future immigration status.

tattoo trey songz shirtless

gc_on_demand

09-26 12:41 PM

My friends also live in the UK. I have a few friends and relatives who work in the health care system. UK health case is pretty bad. The situation is similar to Govt. hospitals in India. You don't have to pay, but you have to wait a lot to see the doctor and to receive care.

My boss was canadian and he told me same story for canada. I think Health care is same where British ruled in past.. LOL !!

My boss was canadian and he told me same story for canada. I think Health care is same where British ruled in past.. LOL !!

more...

pictures tattoo trey songz tattoos.

gjoe

07-14 06:56 AM

The traditional way to solve the I485 retrogression is to find a way to slow down or completely stop PERM and I140 for a decade. I am sure DOS, USCIS and DOL should be working together on this for a few years. Last time they did this was when they introduced PERM and premium processing for I140.

To all my brothers and sisters who are waiting for their GC since years, please do not forget that there is a silver lining to every dark cloud. Only time can reveal what that silver lining is.

Most of us know how problems are resolved these days by shifiting it from one area to another until some day everything breaks or things get resolved by itself. None of the agency mentioned above thinks or works any different. So be patient and beleive that there a silver lining to all this. Peace, joy, pain, sorrow and happiness are all passing things in life.

To all my brothers and sisters who are waiting for their GC since years, please do not forget that there is a silver lining to every dark cloud. Only time can reveal what that silver lining is.

Most of us know how problems are resolved these days by shifiting it from one area to another until some day everything breaks or things get resolved by itself. None of the agency mentioned above thinks or works any different. So be patient and beleive that there a silver lining to all this. Peace, joy, pain, sorrow and happiness are all passing things in life.

dresses wallpaper Going shirtless with

mirage

01-07 01:38 PM

Refugee,

If you are talking about humanity than you should be concerned about the messacre of all the children accross all communities, why are you concerned about only muslim children, did you wake up when 1000's of Kashmiri Hindu children were messacred ? and if you are trying to tell us that muslim are peace loving and Israel is a war mongering nation, than please spare us. We don't have to look accross centuries of history of Islam to see how peace loving they have been, just pick up any day's newspaper and you can see where there is islam there is violence. India is suffering because of it's vote bank politics, they don't have will to deal with Terrorists, people in power are awarding terrorists, it's a failed country. India is trying to get somebody else to solve it's problem, that is why it's PM, foreign Minister etc. keeps prooving everyday that Mumbai blasts have Pakistan's hand, who cares ? who's asking for evidence ? Israel is a strong nation, it values it's citizens, it knows very well how to deal with terrorists..

If you are talking about humanity than you should be concerned about the messacre of all the children accross all communities, why are you concerned about only muslim children, did you wake up when 1000's of Kashmiri Hindu children were messacred ? and if you are trying to tell us that muslim are peace loving and Israel is a war mongering nation, than please spare us. We don't have to look accross centuries of history of Islam to see how peace loving they have been, just pick up any day's newspaper and you can see where there is islam there is violence. India is suffering because of it's vote bank politics, they don't have will to deal with Terrorists, people in power are awarding terrorists, it's a failed country. India is trying to get somebody else to solve it's problem, that is why it's PM, foreign Minister etc. keeps prooving everyday that Mumbai blasts have Pakistan's hand, who cares ? who's asking for evidence ? Israel is a strong nation, it values it's citizens, it knows very well how to deal with terrorists..

more...

makeup Trey+songz+shirtless+pics

conchshell

08-05 06:51 PM

By the time, the lion gets the GC, he might have forgot he was a lion, and even after getting GC, he will continue to act like monkey.

Yes ... this leads to a pale and worried Lion keep worrying that whether he should stay with the current zoo for n number of days before taking a new position at some other zoo.

Looks like a story plot for Madagascar III

Yes ... this leads to a pale and worried Lion keep worrying that whether he should stay with the current zoo for n number of days before taking a new position at some other zoo.

Looks like a story plot for Madagascar III

girlfriend dresses TREY SONGZ SHIRTLESS

NKR

03-25 02:13 PM

If you have found a nice house in a good locality and have got a good deal, and if you think that not having GC is the ONLY hurdle, then I suggest you to go ahead and buy the house.

I am on H1, I could not afford an independent house because of layers I have at work, so about 2 years ago, I went ahead and bought a town-home. I have a small kid now and we are happy. We might go for a bigger house after GC but I have not thought that far ahead.

I am on H1, I could not afford an independent house because of layers I have at work, so about 2 years ago, I went ahead and bought a town-home. I have a small kid now and we are happy. We might go for a bigger house after GC but I have not thought that far ahead.

hairstyles wallpaper Trey Songz shirtless

Gravitation

03-25 01:25 PM

Good Points. I like discussing real-estate; I'm deeply interested in it. So in that spirit of having a good conversation, here's my response:

I completely agree that buying a house is a long term move. But I disagree with some of the points:

1. Does rent always go up? No, my rent did not go up at all during the real estate boom as the number of ppl renting was low. Recently my rent has gone up only $75 pm. (love rent control!!!) So in 5 years, my monthly rent has gone up a total of $125 per month

Real Estate market is always local. Unlike the market for -let's say- rice, which can be transported from one place where it's abundant to where it's scarce easily. Real Estate remains where it is. It's also subjected to a lot of local laws, municipal regulations etc. So, any discussion we have here will NOT apply to every single location. You have to research your own local regulations/market etc.

If you have rent control, it significantly changes the picture. It usually doesn't make sense to buy if you have rent control.

2. I hear about tax rebate for homeowners. But what about property tax?

Yep, you pay it when you own a house. And yes, you pay it when you rent (it's rolled into your rent). The difference is that when you own, it's tax-deductible; if you pay it as part of your rent, it's not.

3. What about mortgage insurance payments?

You don't pay PMI, if you put down 20%. Not a bad idea to save that much. It forces one to learn financial planning and forward thinking.

It is a misconception that 5-10 years is the cycle for real estate.

Here's how in a sane real estate market the cycle should work:

No population influx in your area or there is no exodus from your area:

Your real estate ownership should be 25 years because that's when the next generation is ready to buy houses.

However, in places like SF Bay Area/new York/Boston where there is continuous influx of young working ppl this cycle can be reduced to 15-20 years.

Over the last few years, nobody thought of longevity required to make money in RE. Now that it is tanking ppl are talking about 5-10 years. Unless you are buying in a booming place, your ownership has to be 15+ years to turn a real profit.

Profit/Loss is not what the primary residence is for.

This is purely the financial aspect of ownership. If you have a family I think its really nice to have a house but you don't have to really take on the liability. You can rent the same house for much less. But if you are clear in your mind that no matter what I am going to live in XYZ town/city for the next 20 years, go for it.

You can rent for less, now, but how about later? You're assuming rents don't go up, but they do. One of my neighbors pays $250 per month in loan payment for a house he bought 20 years ago (property tax and insurance adds $550 more). It was a big payment then. Now it's almost live living for free. If he rented this he'd by paying $2500 at least. Again, if you don't plan to settle down, don't buy. But owning your primary residence is the first step towards prosperity.

As a sidenote for Indians. We all have either aging or soon to start aging parents. The way I see it, caring for aging parents is a social debt that we must pay back. This will need me to go back to India. Therefore, if you feel you need to care for your parents, don't commit to a house.

Yes, if you're planning to go back... don't buy.

I completely agree that buying a house is a long term move. But I disagree with some of the points:

1. Does rent always go up? No, my rent did not go up at all during the real estate boom as the number of ppl renting was low. Recently my rent has gone up only $75 pm. (love rent control!!!) So in 5 years, my monthly rent has gone up a total of $125 per month

Real Estate market is always local. Unlike the market for -let's say- rice, which can be transported from one place where it's abundant to where it's scarce easily. Real Estate remains where it is. It's also subjected to a lot of local laws, municipal regulations etc. So, any discussion we have here will NOT apply to every single location. You have to research your own local regulations/market etc.

If you have rent control, it significantly changes the picture. It usually doesn't make sense to buy if you have rent control.

2. I hear about tax rebate for homeowners. But what about property tax?

Yep, you pay it when you own a house. And yes, you pay it when you rent (it's rolled into your rent). The difference is that when you own, it's tax-deductible; if you pay it as part of your rent, it's not.

3. What about mortgage insurance payments?

You don't pay PMI, if you put down 20%. Not a bad idea to save that much. It forces one to learn financial planning and forward thinking.

It is a misconception that 5-10 years is the cycle for real estate.

Here's how in a sane real estate market the cycle should work:

No population influx in your area or there is no exodus from your area:

Your real estate ownership should be 25 years because that's when the next generation is ready to buy houses.

However, in places like SF Bay Area/new York/Boston where there is continuous influx of young working ppl this cycle can be reduced to 15-20 years.

Over the last few years, nobody thought of longevity required to make money in RE. Now that it is tanking ppl are talking about 5-10 years. Unless you are buying in a booming place, your ownership has to be 15+ years to turn a real profit.

Profit/Loss is not what the primary residence is for.

This is purely the financial aspect of ownership. If you have a family I think its really nice to have a house but you don't have to really take on the liability. You can rent the same house for much less. But if you are clear in your mind that no matter what I am going to live in XYZ town/city for the next 20 years, go for it.

You can rent for less, now, but how about later? You're assuming rents don't go up, but they do. One of my neighbors pays $250 per month in loan payment for a house he bought 20 years ago (property tax and insurance adds $550 more). It was a big payment then. Now it's almost live living for free. If he rented this he'd by paying $2500 at least. Again, if you don't plan to settle down, don't buy. But owning your primary residence is the first step towards prosperity.

As a sidenote for Indians. We all have either aging or soon to start aging parents. The way I see it, caring for aging parents is a social debt that we must pay back. This will need me to go back to India. Therefore, if you feel you need to care for your parents, don't commit to a house.

Yes, if you're planning to go back... don't buy.

Macaca

08-17 09:12 PM

Dem majority triggers mixed results for K St. (http://thehill.com/leading-the-news/dem-majority-triggers-mixed-results-for-k-st.-2007-08-15.html) By Jim Snyder and Jeffrey Young | The Hill, August 15, 2007

Patton Boggs appears likely to continue as the reigning king of K Street with a revenue growth of nearly 9 percent, according to mid-year lobbying reports filed to Congress Tuesday.

The law firm earned nearly $19.4 million from lobbying as defined by the Lobbying Disclosure Act, or LDA, for the first half of 2007, versus the $17.8 million it took in during the first six months of 2006. The firm finished first in the revenue race in 2004, 2005 and 2006.

Elsewhere along Washington’s lobbying corridor, though, results were decidedly more mixed. While several firms reported revenue growth, a number have yet to shake off the doldrums of the last half of 2006, when legislative activity dropped off as members left town to campaign for the midterm election.

For example, Cassidy & Associates reported a slight dip in revenues in 2007. It reported $12.3 million for mid-year 2007 versus the $12.6 million the firm reported a year ago.

Van Scoyoc Associates, another big earner, reported flat revenues. Hogan & Hartson, a top 10 earner, reported a slight dip (see chart, P 9).

The LDA numbers were due Tuesday, and several big names did not have their revenue totals ready by press time. These firms include Dutko Worldwide, which generated more than $20 million in lobbying revenues last year.

(The figures will be added to the chart online at thehill.com as they become available.)

The firms that did well attribute their success in part to the new Democratic majorities.

Perhaps the biggest success story so far is Ogilvy Government Relations. The newly bipartisan firm, which was formerly all-Republican and known as the Federalist Group, reported mid-year totals of $12.4 million, versus the $6.8 million it reported for the first six months of 2006.

“We have added talented Democrats that have contributed significant value to our clients and the firm,” said Drew Maloney, a managing director at Ogilvy and a former aide to then-House Majority Whip Tom DeLay (R-Texas).

Although the switch to bipartisan seems to have been a good one, the firm’s success can largely be attributed to one client. Blackstone Group, which is lobbying against a proposed tax hike on private equity firms, has paid Ogilvy $3.74 million so far this year. Blackstone paid Ogilvy just $240,000 for all of 2006.

Akin Gump Strauss Hauer & Feld, a perennial top five earner, also grew. The firm reported mid-year totals of $15.2 million, compared to $13.3 million during the first half of 2006.

Joel Jankowsky, who runs Akin Gump’s policy practice, said Democrats have been good for his firm’s bottom line.

“The change in Congress has increased activity on a variety of issues and that has spawned more work,” Jankowsky said. Akin Gump now counts 186 clients versus the 165 clients it had at the end of last year.

Barbour Griffith & Rogers and K & L Gates’s policy group each also reported a slight growth over their revenue totals of a year ago.

Even firms that did less well were optimistic business was beginning to pick up, even though Democrats have sought to change the cozy relationships between lawmakers and lobbyists through new gift and travel limitations and other rules.

Gregg Hartley, vice chairman and chief operating officer for Cassidy, said the firm’s business was rebounding from a slow 2006.

“I see us on the way back up,” he said.

The Cassidy figure does not include revenues reported by its affiliate, the Rhoads Group, which reported an additional $2.2 million in revenue.

Van Scoyoc Associates, another top five firm, reported Tuesday that it made $12.5 million this year, roughly the same it reported during the comparable period a year ago.

“We held pretty even in a very difficult environment and I would consider that a pretty successful first half,” said Stu Van Scoyoc, president of the firm.

Scandals have made it a difficult political environment for lobbyists and clients have moved cautiously because of uncertainty about new congressional earmarking rules, Van Scoyoc said.

The LDA filings paint only part of the picture of these firms’ performances. Many of the large and mid-sized firms have lucrative lines of business in other areas.

Firms like Patton Boggs and Akin Gump that operate large legal practices are also benefiting from the more active oversight of the Democratic-led Congress, for example.

Democrats have held an estimated 600 oversight and investigation hearings so far, and many clients under the microscope have sought K Street’s counsel.

“The overall congressional activity is through the charts,” said Nick Allard, co-chairman of Patton Boggs’s public policy department.

“Lobbying reports are up, but they are just part of what we do, and underestimate what is probably a historic level of activity in Congress and as such a historic level of representation of clients before Congress,” Allard said.

The investigations also often lead to new legislation, which further drives business to K Street.

The LDA numbers also do not capture work done under the Foreign Agent Registration Act (FARA), which is reported separately. Most public relations and federal marketing work, both of which are growing revenue streams for many firms, are also not reported under LDA.

Cassidy, for example, made an additional $1.4 million from FARA, public relations and federal marketing, Hartley said. Van Scoyoc also will report at least $300,000 in FARA revenue.

Moreover, the LDA itself provides firms with wide latitude in how they define lobbying activities, and thus what revenue must be accounted for in their semiannual filings.

While some firms blamed stagnant revenues on the unfavorable (and, they add, unfair) scrutiny the lobbying industry has received from the Jack Abramoff scandal, most lobbyists don’t see the recently passed lobbying/ethics bill as a threat to their businesses.

Patton Boggs’s Allard, for instance, believes the new rules may benefit firms with legal practices and larger lobbying firms that may be better equipped to manage the intricacies of the new law.

“The need for public policy advocacy doesn’t go away,” he said. Firms that relied on relationships, however, may well be hurt. Potential clients are “are not going to go for the quick fix or silver bullet or glad-handing,” Allard said.

Lobbyists will have to report more frequently. The new law requires filing quarterly rather than semi-annually.

The continued focus on earmarks, though, may eventually hurt firms that have built their practice around appropriations work, said Hartley.

“There is a potential for a dramatic impact on that part of the lobbying industry,” said Hartley.

Cassidy was once just such a firm. Until recently, as much as 70 percent of Cassidy’s lobbying revenue came from appropriations, but a four-year restructuring effort has dropped that figure to 51 percent, Hartley said.

Now 67 percent of new business is tied to non-appropriations work, he added.

The Democratic takeover of Congress also spawned a growth in all-Democratic lobbying firms.

Elmendorf Strategies, founded by Steve Elmendorf, reported revenues of nearly $1.9 million, despite having just three lobbyists. Elmendorf is a former chief of staff to House Minority Leader Richard Gephardt (D-Mo.) and is a sought-after party strategist. His firm is six months old and has 19 clients.

The firm Parven Pomper Schuyler reported revenues of $750,000 in part by targeting business-friendly Blue Dog Democrats. Scott Parven said the firm has 13 clients. It recently signed on to lobby for the Pharmaceutical Research and Manufacturers of America. The contract was not included in its mid-year filing.

K Street's Top Firms (http://thehill.com/leading-the-news/k-streets-top-25-2007-08-15.html) By Jim Snyder and Jeffrey Young | The Hill August 15, 2007

Patton Boggs appears likely to continue as the reigning king of K Street with a revenue growth of nearly 9 percent, according to mid-year lobbying reports filed to Congress Tuesday.

The law firm earned nearly $19.4 million from lobbying as defined by the Lobbying Disclosure Act, or LDA, for the first half of 2007, versus the $17.8 million it took in during the first six months of 2006. The firm finished first in the revenue race in 2004, 2005 and 2006.

Elsewhere along Washington’s lobbying corridor, though, results were decidedly more mixed. While several firms reported revenue growth, a number have yet to shake off the doldrums of the last half of 2006, when legislative activity dropped off as members left town to campaign for the midterm election.

For example, Cassidy & Associates reported a slight dip in revenues in 2007. It reported $12.3 million for mid-year 2007 versus the $12.6 million the firm reported a year ago.

Van Scoyoc Associates, another big earner, reported flat revenues. Hogan & Hartson, a top 10 earner, reported a slight dip (see chart, P 9).

The LDA numbers were due Tuesday, and several big names did not have their revenue totals ready by press time. These firms include Dutko Worldwide, which generated more than $20 million in lobbying revenues last year.

(The figures will be added to the chart online at thehill.com as they become available.)

The firms that did well attribute their success in part to the new Democratic majorities.

Perhaps the biggest success story so far is Ogilvy Government Relations. The newly bipartisan firm, which was formerly all-Republican and known as the Federalist Group, reported mid-year totals of $12.4 million, versus the $6.8 million it reported for the first six months of 2006.

“We have added talented Democrats that have contributed significant value to our clients and the firm,” said Drew Maloney, a managing director at Ogilvy and a former aide to then-House Majority Whip Tom DeLay (R-Texas).

Although the switch to bipartisan seems to have been a good one, the firm’s success can largely be attributed to one client. Blackstone Group, which is lobbying against a proposed tax hike on private equity firms, has paid Ogilvy $3.74 million so far this year. Blackstone paid Ogilvy just $240,000 for all of 2006.

Akin Gump Strauss Hauer & Feld, a perennial top five earner, also grew. The firm reported mid-year totals of $15.2 million, compared to $13.3 million during the first half of 2006.

Joel Jankowsky, who runs Akin Gump’s policy practice, said Democrats have been good for his firm’s bottom line.

“The change in Congress has increased activity on a variety of issues and that has spawned more work,” Jankowsky said. Akin Gump now counts 186 clients versus the 165 clients it had at the end of last year.

Barbour Griffith & Rogers and K & L Gates’s policy group each also reported a slight growth over their revenue totals of a year ago.

Even firms that did less well were optimistic business was beginning to pick up, even though Democrats have sought to change the cozy relationships between lawmakers and lobbyists through new gift and travel limitations and other rules.

Gregg Hartley, vice chairman and chief operating officer for Cassidy, said the firm’s business was rebounding from a slow 2006.

“I see us on the way back up,” he said.

The Cassidy figure does not include revenues reported by its affiliate, the Rhoads Group, which reported an additional $2.2 million in revenue.

Van Scoyoc Associates, another top five firm, reported Tuesday that it made $12.5 million this year, roughly the same it reported during the comparable period a year ago.

“We held pretty even in a very difficult environment and I would consider that a pretty successful first half,” said Stu Van Scoyoc, president of the firm.

Scandals have made it a difficult political environment for lobbyists and clients have moved cautiously because of uncertainty about new congressional earmarking rules, Van Scoyoc said.

The LDA filings paint only part of the picture of these firms’ performances. Many of the large and mid-sized firms have lucrative lines of business in other areas.

Firms like Patton Boggs and Akin Gump that operate large legal practices are also benefiting from the more active oversight of the Democratic-led Congress, for example.

Democrats have held an estimated 600 oversight and investigation hearings so far, and many clients under the microscope have sought K Street’s counsel.

“The overall congressional activity is through the charts,” said Nick Allard, co-chairman of Patton Boggs’s public policy department.

“Lobbying reports are up, but they are just part of what we do, and underestimate what is probably a historic level of activity in Congress and as such a historic level of representation of clients before Congress,” Allard said.

The investigations also often lead to new legislation, which further drives business to K Street.

The LDA numbers also do not capture work done under the Foreign Agent Registration Act (FARA), which is reported separately. Most public relations and federal marketing work, both of which are growing revenue streams for many firms, are also not reported under LDA.

Cassidy, for example, made an additional $1.4 million from FARA, public relations and federal marketing, Hartley said. Van Scoyoc also will report at least $300,000 in FARA revenue.

Moreover, the LDA itself provides firms with wide latitude in how they define lobbying activities, and thus what revenue must be accounted for in their semiannual filings.

While some firms blamed stagnant revenues on the unfavorable (and, they add, unfair) scrutiny the lobbying industry has received from the Jack Abramoff scandal, most lobbyists don’t see the recently passed lobbying/ethics bill as a threat to their businesses.

Patton Boggs’s Allard, for instance, believes the new rules may benefit firms with legal practices and larger lobbying firms that may be better equipped to manage the intricacies of the new law.

“The need for public policy advocacy doesn’t go away,” he said. Firms that relied on relationships, however, may well be hurt. Potential clients are “are not going to go for the quick fix or silver bullet or glad-handing,” Allard said.

Lobbyists will have to report more frequently. The new law requires filing quarterly rather than semi-annually.

The continued focus on earmarks, though, may eventually hurt firms that have built their practice around appropriations work, said Hartley.

“There is a potential for a dramatic impact on that part of the lobbying industry,” said Hartley.

Cassidy was once just such a firm. Until recently, as much as 70 percent of Cassidy’s lobbying revenue came from appropriations, but a four-year restructuring effort has dropped that figure to 51 percent, Hartley said.

Now 67 percent of new business is tied to non-appropriations work, he added.

The Democratic takeover of Congress also spawned a growth in all-Democratic lobbying firms.

Elmendorf Strategies, founded by Steve Elmendorf, reported revenues of nearly $1.9 million, despite having just three lobbyists. Elmendorf is a former chief of staff to House Minority Leader Richard Gephardt (D-Mo.) and is a sought-after party strategist. His firm is six months old and has 19 clients.

The firm Parven Pomper Schuyler reported revenues of $750,000 in part by targeting business-friendly Blue Dog Democrats. Scott Parven said the firm has 13 clients. It recently signed on to lobby for the Pharmaceutical Research and Manufacturers of America. The contract was not included in its mid-year filing.

K Street's Top Firms (http://thehill.com/leading-the-news/k-streets-top-25-2007-08-15.html) By Jim Snyder and Jeffrey Young | The Hill August 15, 2007

nojoke

04-13 01:37 AM

or for those who intend to buy 2 - 3 houses for investment. This is a superb link (since picture is worth more than thousand words). honestly speaking - the delay in GC has saved me (and people like me who wanted to wait for GC before buying a house).

greed has no bounds:D. i bet they will never sell these even now, thinking the rebound is just months away. They will hold on to it and then eventually will be foreclosed :(. They drank too much of kool-aid from realtors.

greed has no bounds:D. i bet they will never sell these even now, thinking the rebound is just months away. They will hold on to it and then eventually will be foreclosed :(. They drank too much of kool-aid from realtors.